We did it!!!!!!!!!!, bitcoin reached 70000 dollars, the date… The date, never forget: March 8, 2024, this represents a milestone in the history of cryptocurrencies, for the first time a purely digital element, an intangible idea, a unit of exchange, a simple algorithm, achieves such a goal, clearly there will be more milestones, but in this case it is quite unique, and in fact it may be the most important milestone of all because it would be the beginning of a new era.

The barrier of 70,000$

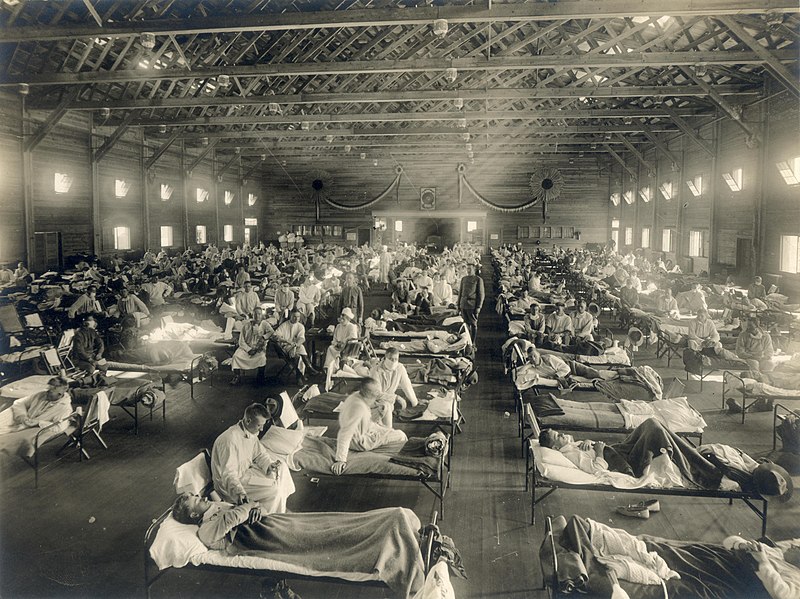

Certainly, by now the value of Bitcoin has dropped, even going below $70k, but it still represents the first sign of what’s to come Historically, there have been two previous moments when Bitcoin surpassed $60k, but that was in 2021 during the peak of the coronavirus pandemic It was a time of uncertainty, and Bitcoin was one of the easiest assets to use Consider this: during quarantine, if the pandemic worsened, physical assets like gold would have limitations in trade, fear of contact would hinder the use of cash, and bank credit/debit cards might have functionality issues Internet, for strategic reasons, would be a priority to maintain Amidst this uncertainty, Bitcoin reached very high values during the pandemic.

Fortunately, the pandemic wasn’t as bad as we thought COVID-19, even though it mutated into new strains (and still does, that’s a topic for another article), wasn’t as deadly as one might think Eventually, the quarantine ended, only for cryptocurrencies to plummet in price for various reasons beyond the scope of this article, not recovering until 2024, surpassing a new limit.

But why is 70k $ an important milestone? Some think it’s just a temporary Bitcoin bubble, but there are events pushing the prices:

*) 2024 is an election year in the United States where the controversial Donald Trump could be the winner.

*) The weakness of the American economy is evident, and the dollar is gradually losing ground to other currencies like the yuan, ruble, and yen This would push many to seek refuge in cryptocurrencies.

*) The conflict in Ukraine would end with Russia’s victory, and tensions with Europe could worsen The risk of a world war becomes a reality, and in a hypothetical war scenario, it’s possible that internet infrastructure would function minimally In that case, cryptocurrencies would be very useful.

*) Many investors take Bitcoin and other cryptocurrencies seriously because, in the end, it’s an asset that, on average, is growing in value (despite fluctuations) as the years go by Especially since the US Securities and Exchange Commission approved 11 monitoring spaces for exchange-traded funds (Bitcoin ETFs) on the stock market on January 10th, an instrument that allows tracking Bitcoin’s price in relation to other assets This makes buying and selling Bitcoins easier on brokerage houses and exchanges.

*) Mining (performing cryptographic mathematical operations to maintain the integrity of the blockchain for transactions) remains a quite profitable activity, especially during times of higher Bitcoin price expectations, as it continues to expand the blockchain to new limits.

*) The Bitcoin halving is approaching, a phenomenon where the rewards for each mined Bitcoin block are cut in half, making it more difficult and expensive to mine new Bitcoins This results in a push towards higher prices Let’s remember that this event was programmed during Bitcoin’s creation The blockchain records the number of Bitcoins, and once a certain number is reached, the halving occurs Initially, the reward was 50 Bitcoins per mined block, but it gradually decreased The other halvings happened at:

1) November 28, 2012, it went down to 25 bitcoins.

2) July 9, 2016, the reward went down to 125 bitcoins.

3) May 11, 2020, the reward went down to 625 bitcoins.

4) The next Halving will happen in April 2024, where the reward will be only 3125 Bitcoins per mined block.

All of this makes us think that Bitcoin will continue to rise in price, paving the way for the $100,000 barrier, which will be a very strong psychological barrier and possibly the definitive consecration of cryptocurrencies in the global economy.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?